Unite

The

Vision

Unite Japan and the world

Working together to achieve the visions of our stakeholders.

Our

Vision

for...

MORE

Client

CLIENT

We aim to be the most trusted partner in both Japan and the United States.

Employee

EMPLOYEE

We aim to create an environment in which employees can achieve self-fulfillment and become a global active group of professionals.

Society

SOCIETY

We aim to create a society where international expansion feels more accessible and familiar.

SERVICE

SERVICE

U.S. MARKET ENTRY AND EXPANSION SUPPORT

No.1 Partner for U.S. Expansion

Expanding your business into the United States is a crucial step towards achieving your vision, but it comes with significant barriers such as language, legal systems, and procedural complexities. At Univis America Group, consultants well-versed in U.S. practices will support your entry into the U.S. market and subsequent business expansion from an accounting, tax, and labor perspective.

CLIENT

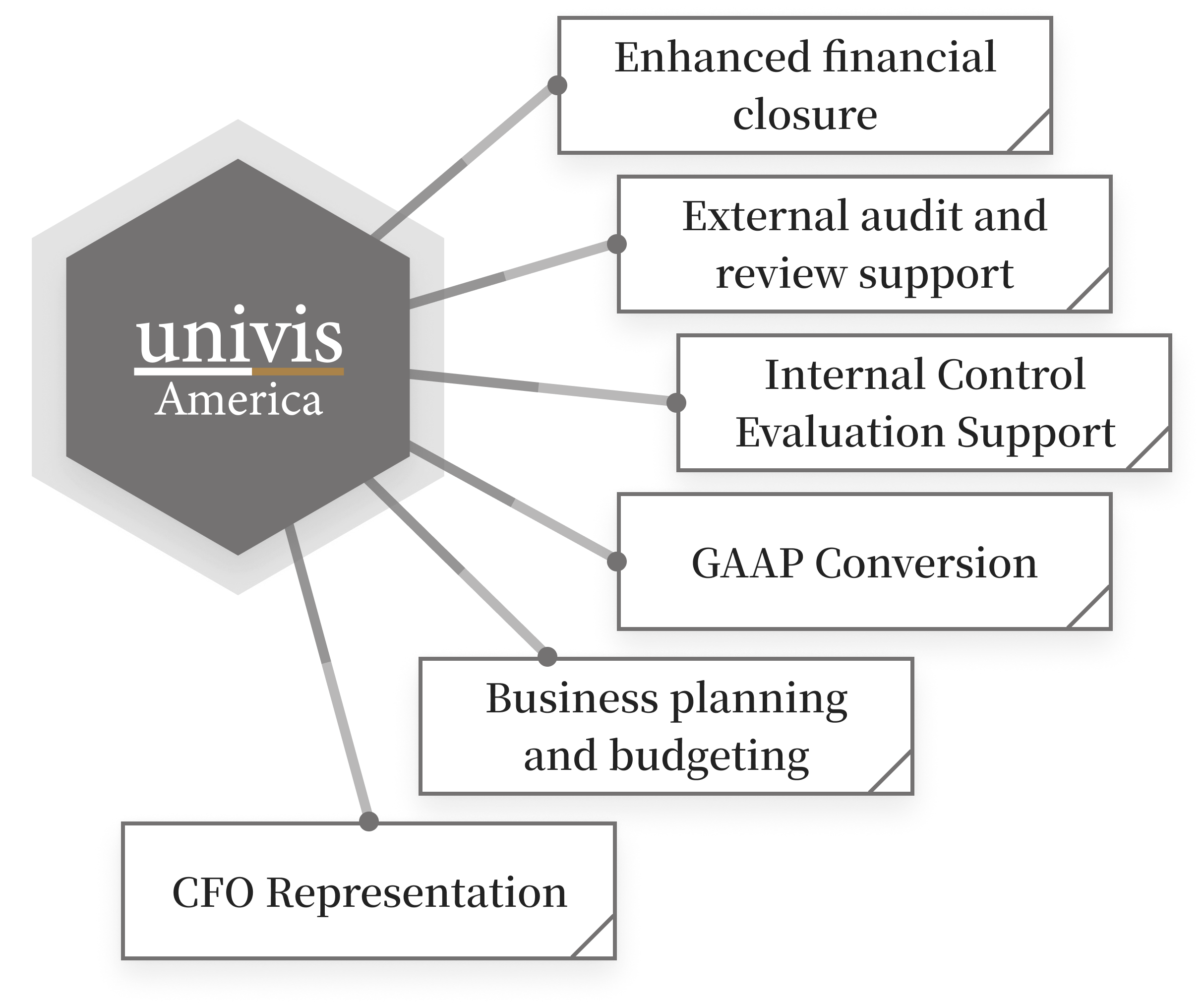

ACCOUNTING CONSULTING

Accounting Services Bridging Japan and the World

After expanding operations overseas, various challenges arise in sustaining continuous business growth in

each country due to differences in accounting systems, culture, and business practices.

At Univis America Group, experienced consultants with qualifications as certified public accountants in

both Japan and the United States provide support for accounting-related tasks that require specialized and

advanced accounting knowledge.

CLIENT

REAL ESTATE INVESTMENT SUPPORT

Accurate Tax Filings for Attractive Investment Opportunities

U.S. real estate offers significantly attractive tax benefits compared to real estate investment in Japan

due to differences in tax regulations between the two countries.

At Univis America Group, consultants well-versed in U.S. real estate practices and tax laws provide

comprehensive support, from consultations during investment consideration to handling bookkeeping and tax

filings necessary after the investment execution.

PARTNERS

CONTACT

Contact Us

Whether your company or you as an individual are

facing concerns regarding accounting or

taxation in the United States,

or if you have inquiries related to

collaboration discussions or interviews,

please feel free to contact us.